Search Site

Back to Menu

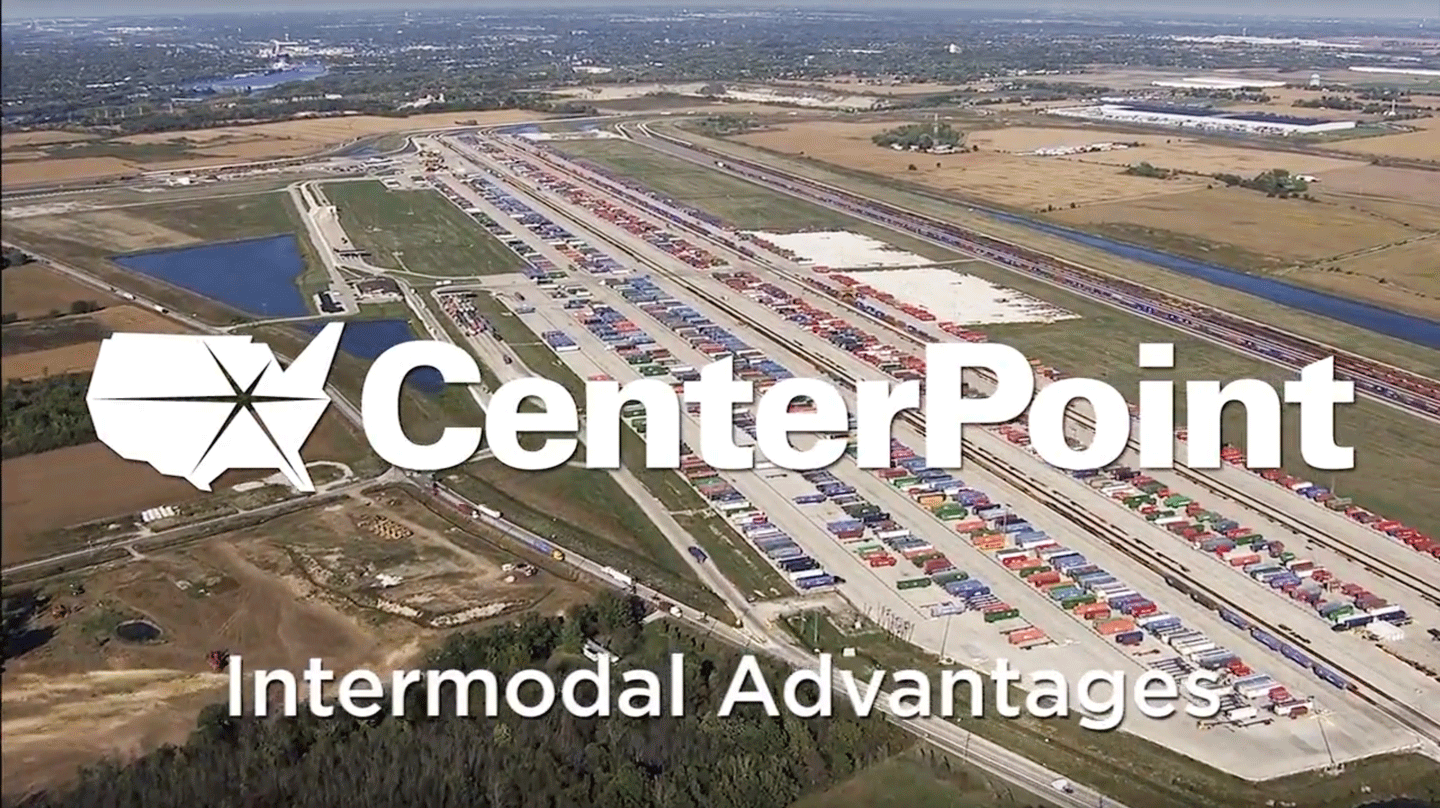

Intermodal Advantages

Executive Summary

In recent years, “intermodal” has been an inescapable buzzword. From transportation to logistics and industrial real estate, everyone has something to say, or questions to ask, about this rising trend. CenterPoint Properties, a market leader in transportation-advantaged industrial real estate solutions, sought to define and examine the state of intermodal through a twenty-first century lens.

This white paper details the development of intermodal transportation since the start of the new millennium, identifying the economic and regulatory forces behind its rapid resurgence, and the benefits it presents to retail and logistics organizations that operate supply chain facilities in intermodal-proximate areas.

The opportunities intermodal creates for organizations – from increased supply chain stability to leaner operating costs – are in vogue now, but they have tremendous staying power. As globalization and consumer shopping behaviors evolve, strategically located property will be a must-have for cargo owners.

Introduction

Modern intermodal transport is a concept more than 50 years in the making. Dating back as early as 1956, when the first freight containers were shipped from Newark to Houston, this mid-twentieth century model is undergoing a renaissance.

From the rise of container shipping and standardization, a new supply chain paradigm emerged; integrated transportation networks that can move cargo seamlessly, reduce costs and jumpstart efficiency.

The State of North American Intermodal Shipping

Intermodal broadly refers to the movement of freight across multiple modes of transportation, from railroads and trucks to ocean carriers. More tightly integrated supply chains facilitate U.S. imports and exports, while ensuring that goods are shipped faster and more affordably across the continent.

Over the past decade, one of the primary drivers of intermodal shipping’s rise has been the downward spiral of U.S. trucking. A combination of dwindling talent supply, fuel price volatility and new federal regulations has forced retailers and distributors to diversify their transportation strategies.

Shrinking Labor Pool

According to the American Trucking Associations, around 25,000 trucking jobs are unfilled in the U.S.1 In the second quarter of 2014, trucking labor turnover, a common proxy for measuring the labor gap, rose 11 percentage points to an annualized rate of 103%, its highest point in nearly two years.2 Contributing to these issues are new federal regulations, which limit the consecutive hours of service truck drivers can be on the road, and drivers’ growing desire for “normalized” schedules to accommodate a better work-life balance. These factors are making it increasingly difficult to secure long-haul drivers to meet the current demand.

Tighter Regulations

In July 2013, the Federal Motor Carrier Safety Administration began enforcing new provisions under the Hours of Service Final Rule for truck drivers. The revised regulations strain long haul trucking productivity by limiting 34-hour restarts, imposing stricter rest break standards and penalties for driver noncompliance.3

These mounting roadblocks to effective trucking have given intermodal new momentum. Today there are nearly 1,100 intermodal facilities in the U.S., including rail terminals, ramps, container yards and depots.5 From the first quarter of 2013 to the same period in 2014, the domestic intermodal system moved more than 19,000 containers and trailers of dry van freight per calendar day—a year-over-year increase of nearly 500 units per day.6

Despite a slight dip around the financial crisis (2007-2009), intermodal loadings have been on a consistent upswing since 2000.7 During this time, organizations have become more focused on increasing supply chain speed and efficiency, decreasing their carbon footprints and finding new ways to capitalize on global trade.

To accommodate these new demands and growing freight volumes, transportation organizations – rail operators in particular – are investing heavily in their own intermodal offerings. In 2014, three of the largest North American railroads added or expanded their continental intermodal service, including Union Pacific (UP), Burlington Northern Santa Fe (BNSF) and Norfolk Southern (NS).

This intermodal boom is forcing retailers, distributors and third party logistics firms to rethink not only how their supply chains run, but where.

Clearing a Path for a New Class of Property

Across the country, the swelling volume of intermodal facilities is creating industrial real estate hotspots: areas in close proximity to multiple forms of transportation, population centers or both. These transportation-advantaged properties are quickly becoming the darlings of industrial real estate.

Major brands from BMW to Walmart and the logistics firms that service them are planting roots along the country’s key intermodal corridors, including the Midwest, West Coast and Southeast regions. Five regional corridors saw record growth at or above the industry average in Q3 2014, according to the Intermodal Association of North America. Within the Southeast alone, activity jumped 10%.8

Measuring the Appeal of Intermodal

Intermodal shipping, and investing in intermodal-proximate real estate, offers tenants a variety of strategic business benefits, from stronger risk management to improved brand equity.

Timely Risk Management

For risk-averse organizations seeking to insulate themselves from supply chain volatility, intermodal’s transportation-neutral model is a core advantage. The ongoing truck driver shortage, increasing regulatory pressures and uncertainty surrounding the future of the U.S. Highway Trust Fund proves that relying on a single mode of transportation is a precarious maneuver.

Organizations that capitalize on intermodal have more options for moving goods, making them less likely to suffer increased expenses or unanticipated delays due to natural disasters, infrastructure concerns or other supply chain fluctuations.

Leaner Operating Expenses

The bottom line savings potential via intermodal has played a significant role in fueling industrial real estate development. As firms seek new ways to cut costs, the prospect of having immediate access to cost-effective transportation methods more than offsets the initial investment of relocation or facility development. With the rising price tag of both trucking and air shipping (the cost of shipping via air freight is more than 33 times that of its rail counterpart, at $1.35 per ton mile versus $0.04) organizations can’t afford to use one transportation mode for long hauls.9

The opportunity to reduce drayage fees has been another key contributor in the recent push for intermodal-adjacent industrial real estate development. After slipping down between 2009 and 2010, drayage operator costs are beginning to stabilize and, in some instances, creep above pre-recession levels. Organizations that shrink the distance between their facilities and available transportation can reduce drayage expenses to a fraction of their former amount. Walmart, for example, has saved $100 on every container move since opening distribution facilities within the CenterPoint Intermodal Center in Elwood, IL, a strategy that has yielded millions in drayage savings over the years.10,11

Satisfied Consumer Demands

Beyond immediate cost savings and mitigated risk, intermodal shipping helps organizations accommodate emerging consumer expectations, specifically around corporate sustainability and e-commerce fulfillment.

According to a June 2014 report by Accenture and Havas Media, nearly half of U.S. consumers will start considering a brand’s stance on sustainability when making purchasing decisions in the next twelve months, and more than 20% currently do so.12

For retailers especially, supply chain management presents an ideal entry point for embedding more environmentally conscious practices. Intermodal rail plays an outsized role in organizations’ efforts to go green without added expense, accounting for only 2.5% of transportation-based greenhouse gas emissions in the U.S.13 A single double-stack train alone translates into 300 trucks removed from highways.

And as e-commerce expands, even brick-and-mortar retailers are being forced to meet new customer demands. Same and next-day delivery options have encouraged retailers to create more flexible supply chains, and operate omni-channel fulfillment centers where traditional and online orders can be handled simultaneously. At the same time, pressure from online competitors has forced retailers to broaden their product offerings, necessitating supply chains with wider reach.

To maintain service quality, big brands are scrambling to acquire industrial real estate with prime access to transportation nodes and nearby population centers. Walmart and The Home Depot are two national retailers that service Midwest stores and customers through distribution centers within the CenterPoint Intermodal Center in Joliet/Elwood, IL, just outside of Chicago. More recently, Amazon has begun pursuing plans to develop fulfillment centers in Southern Wisconsin and the Chicago area to expedite deliveries.

Spotlight: CenterPoint Intermodal Center — Joliet/Elwood

Since its development in the early 2000s, CIC-Joliet/Elwood has been the largest master-planned inland port in North America. Just 40 miles southwest of Chicago, the complex spans more than 6,500 acres of rail and highway-adjacent land. The two largest Class I railroads in the world, BNSF and UP, operate intermodal terminals at CIC-Joliet/Elwood, providing users unparalleled access to regional and coastal markets. A wide collection of retailers, service providers and 3PL firms including Walmart, The Home Depot, NFI and DSC Logistics call CIC-Joliet/Elwood home.

One of CIC-Joliet/Elwood’s most prominent advantages is its efficiency; 65% of the U.S. population can be reached within a one-day drive of the intermodal center. Based on an estimate of 5,000 intermodal loads, a tenant of CIC-Joliet/Elwood can save nearly 45,000 gallons of fuel annually, and eliminate 700,000 pounds in CO2 emissions.

Taken together, the variety of on-site amenities at CIC-Joliet/Elwood offer tenants significant dray, environmental and trade savings. Due to the close proximity of the BNSF and UP terminals, a 500,000 square foot distribution facility at the Intermodal Center could realize $400,000 in annual drayage savings. The same facility could save more than $300,000 per year through CIC-Joliet/Elwood’s Foreign Trade Zone designation and weekly (rather than per-shipment) customs processing. Common-use and private in-park container yards also help users streamline their container, trailer and equipment storage.

As of October 2014, CIC-Joliet/Elwood is almost halfway to full build-out. At full capacity, CIC-Joliet/Elwood is slated to include 20 million square feet of building space. For more information about CIC-Joliet/Elwood, visit the webpage here.

The Future of Intermodal

Looking ahead, the future of intermodal is expected to be bright. With total domestic freight tonnage forecasted to grow more than 23% by 2025, the demand for viable transportation options is positioned to surge.14

Globalization will keep motivating organizations to seriously consider intermodal. Imports and exports are expected to make up an even greater share of freight moving through the U.S. in the future, accounting for 19% of freight tonnage and 31% of value by 2040. The pending Panama Canal expansion will amplify this trade growth, and fuel investments in Southeastern port markets such as New Orleans, Miami and Charleston.

Over the next few years, intermodal activity may shift between regions and new hubs may emerge in unexpected places. But regardless of how or where intermodal evolves, the benefits it brings to the retail, manufacturing and logistics industries will remain constant. Today, the onus is on industrial real estate firms to develop a supply that can meet tomorrow’s demand.

Sources

Subscribe

Microsite Request