Videos

CenterPoint Spotlight Series: CenterPoint Landing at Oakland Seaport

Search Site

Back to Menu

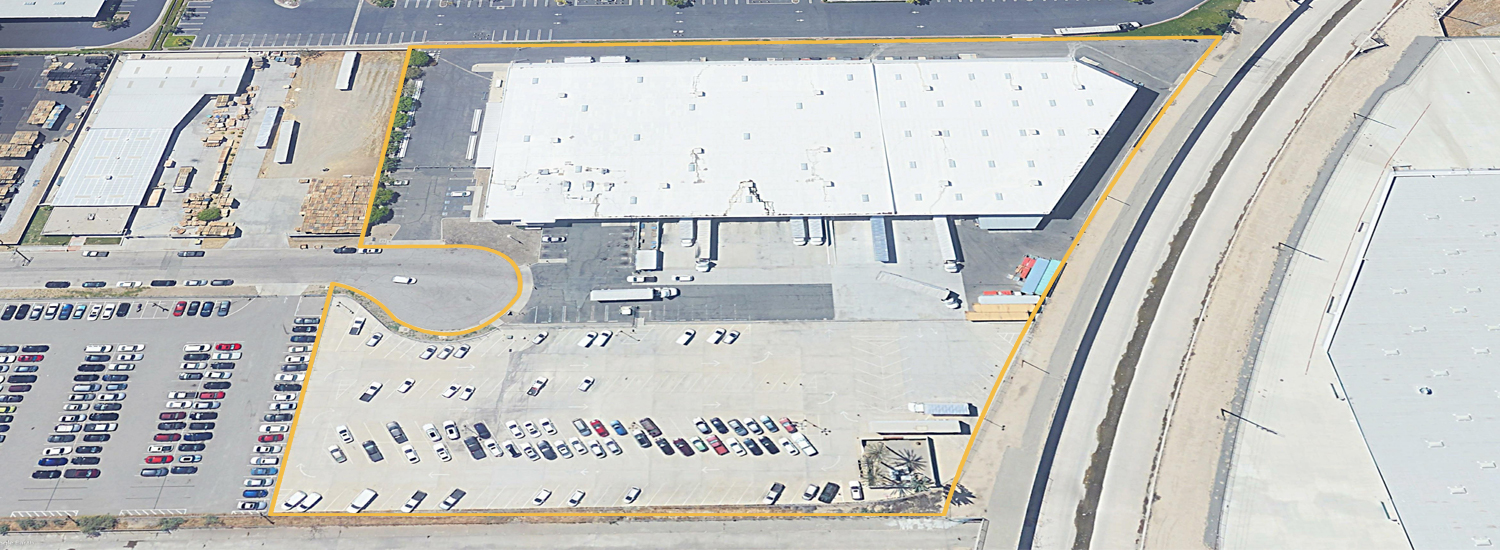

The 91,963-square-foot facility covers just 32 percent of the 6.23-acre property, far below market averages and even lower than the coverage of the few new developments in the land-constrained submarket.

Market conditions in Inland Empire are as tight as ever. Its 1.7 percent vacancy rate in Q2 2021 was one of the lowest in L.A. Analysts predict user demand there is as much as four times greater than supply, and more than 40 percent of developments are preleased.

“In order to accomplish our desired growth targets in Southern CA over the next several years, CenterPoint will be increasing our investment activity in the Inland Empire market,” said Evan Lippow, CenterPoint’s Senior Vice President of Investments. “535 E. Tennis Court is the epitome of the type of deals CenterPoint targets to facilitate our Inland Empire portfolio expansion,” Lippow emphasized.

Industrial users continue to flock to the Inland Empire for its exclusive regional access to an enormous population throughout the Southwestern U.S. and nearly five million people in the immediate area. The Tennis Court property is proximate to the I-10, the national artery that connects L.A. with Phoenix, and the I-215 running through the densely populated communities in Riverside and San Bernardino counties.

Bob Andrews, CenterPoint’s Senior Vice President of Asset Management, said the property’s outstanding location and the building’s advantageous features made it a logical addition to a CenterPoint Southern California portfolio that seemingly grows by the month.

“The site configuration is very efficient for high throughput operations, and the parking for nearly 200 cars is a plus for this submarket as well as for the long-term tenant there, which has hundreds of employees working over three shifts. Add in the interstate access and the fact that it’s 5 miles from a BNSF intermodal terminal, and this is precisely the asset users will compete for in 2021 or 2041,” Andrews said.

Remington Moses and David Bales of Lee & Associates brokered the transaction.

About CenterPoint Properties

CenterPoint is an industrial real estate company made up of dedicated thinkers, innovators and leaders with the creativity and know-how to tackle the industry’s toughest challenges. And it’s those kinds of problems — the delicate, the complex, the seemingly impossible — that we relish most. Because with an agile team, substantial access to capital and industry-leading expertise, those are exactly the kinds of problems we’re built to solve. For more information on CenterPoint Properties, follow us on LinkedIn. For all media inquiries, including requests for interviews with CenterPoint executives, please contact media@centerpoint.com or 630.586.8285.

For CenterPoint Investment, Development, and Asset Management inquiries, please contact:

Subscribe

Microsite Request